Expert-Witness.b2bcfo.com

B2B CFO® has expert witnesses that possess superb credentials.

CV For M. Martin Mercer, J.D., CPA, FCPA, CFE, CFF

Mr. Mercer is one of over 200 partners of B2B CFO® nationwide providing CFO services to growing companies and offering financial fraud investigation, litigation support, forensic accounting, and expert witness services to litigating attorneys. B2B CFOs have, on average, over 25 years of high level finance, accounting and senior level corporate executive experience.

Mr. Mercer leads the B2B CFO® Litigation Services Practice which offers thousands of years of combined experience in virtually every area of finance, accounting and business to litigating attorneys in the areas of litigation support, financial fraud investigations, forensic accounting and expert witness services.

Mr. Mercer is a Certified Public Accountant and an Attorney with over 30 years of experience in business management, financial planning, information technology and software development. He comes from a 'Big 4' accounting background (formerly Coopers & Lybrand) and has accumulated a breadth of experience leading and managing the fiscal, operational and technological functions of companies whose industries include real estate, software development, e-commerce, law, tax, insurance and forensic accounting. His expertise includes finance & accounting, legal/contract negotiations, e-business, e-commerce, strategic marketing, new product development, organizational development and IT integration project development. Additionally, for over 24 years Mr. Mercer taught accounting theory, auditing, business law, and computer science to college students and CPA candidates.

Mr. Mercer's experience includes forensic accounting services to attorneys involved in business litigation and served as Vice President of Financial Fraud Investigations during the Savings & Loan meltdown in the 1990s. He is a Certified Fraud Examiner (CFE), a Forensic Accountant, and is Certified in Financial Forensics (CFF) through the American Institute of Certified Public Accountants (AICPA). Specifically, Mr. Mercer has directed and coordinated financial and computer fraud investigations involving white-collar crime and financial institution losses that includes:

• Providing litigation services assisting in the preparation of pleadings, responses, interrogatories, exhibits, depositions, and direct & cross examinations.

• Analyzing complex real estate transactions where fraud or malfeasance was suspected.

• Interfacing with local law enforcement and the FBI.

• Preparing investigative reports and criminal referrals for submission to the FBI.

• Performing statistical analyses on automotive loan pools to establish that the loan default rate was dramatically higher for loans accepted from specific ‘suspicious’ automobile dealers compared with the general population of automobile dealers in the loan pools as a whole. This information pointed federal investigators to specific loan officers and automobile dealerships, resulting in criminal referrals.

• Successfully defending a company owner/partner against allegations of mismanagement by his business partners resulting in the bankruptcy of his franchised 50-store retail chain. Discovered evidence of long-term embezzlement on the part of the suing partners thereby securing a favorable countersuit settlement for the client.

• Searching for and locating hidden assets of former officers and directors of Savings & Loan institutions just prior to their sentencing hearing.

• Providing litigation support to substantiate a $50 million deduction of accelerated capitalized interest which had been denied by the IRS. Efforts were successful in obtaining a settlement with the IRS wherein $49 million out of the $50 million in previously denied deductions were allowed.

• Providing litigation support attendant to 'expansive soils' class action litigation by developing a database that quantified critical information regarding 20,000 homes built in the Denver Metropolitan Area. The database established a statistically significant relationship between expansive soils and basement complaints and went on to estimate the total potential exposure to the Company. Company’ attorneys were then able to negotiate a favorable settlement to the class action lawsuit brought by homeowners.

• Uncovering fraud and embezzlement by senior executives where company’ revenues and client’ reserves, which had been sequestered for future services, were misappropriated for personal use.

Mr. Mercer graduated with honors from the University of California, Los Angeles (UCLA) with a bachelor's degree in economics and accounting in 1978. He received his Juris Doctorate from the University of the Pacific, McGeorge School of Law in Sacramento, California in 1981. He has been a licensed Certified Public Accountant and Attorney in Colorado since 1981 and comes from a 'Big 4' accounting background having worked for Coopers & Lybrand in the early years of his career. Currently, Mr. Mercer is a partner with B2B CFO ® providing CFO services to growing companies and offering financial fraud investigation, litigation support, forensic accounting, and expert witness services to litigating attorneys on a nationwide basis.

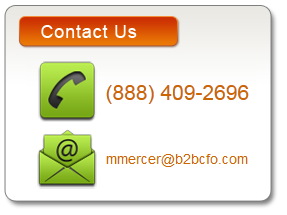

To Contact Mr. Mercer: Via Email: mmercer@b2bcfo.com Via Telephone: (303) 621-5825